Description

The indicator Wolfe Waves Autolines Prediction ULTRA V2 shows the known Wolfe wave patterns. The rules of the known Wolfe Waves come from www.wolfewave.com.

In order to use this indicator after purchase, an unblocked user account on TradingView* is required. Within 24 hours after payment, the indicator will be activated for the ordered period for the TradingView username, entered in the order process.

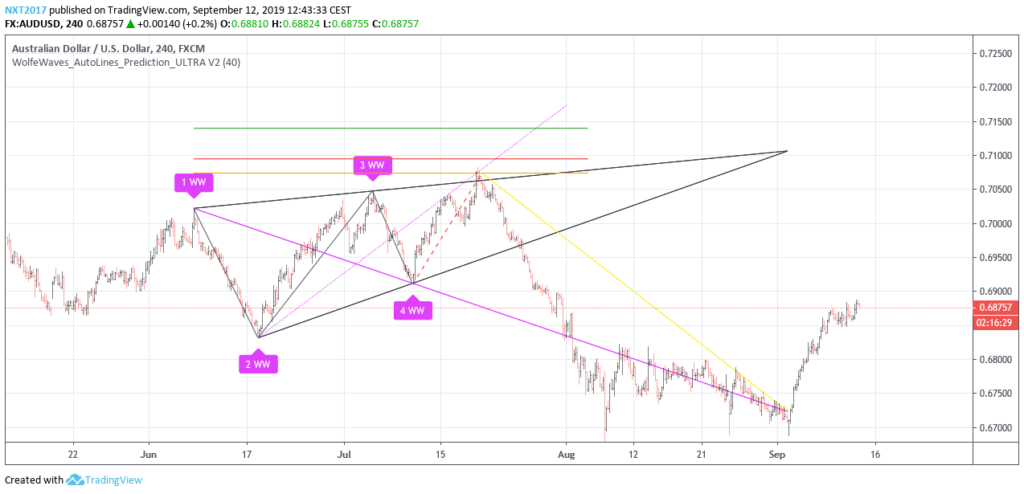

The indikator Wolfe Waves Autolines Prediction ULTRA V2 in action:

How to use the indicator

The three lines above the bearish Wolfe Wave show Fibonacci extensions, where the rebound in the opposite direction usually occurs:

- yellow: 1.272

- red: 1.382

- green: 1.618

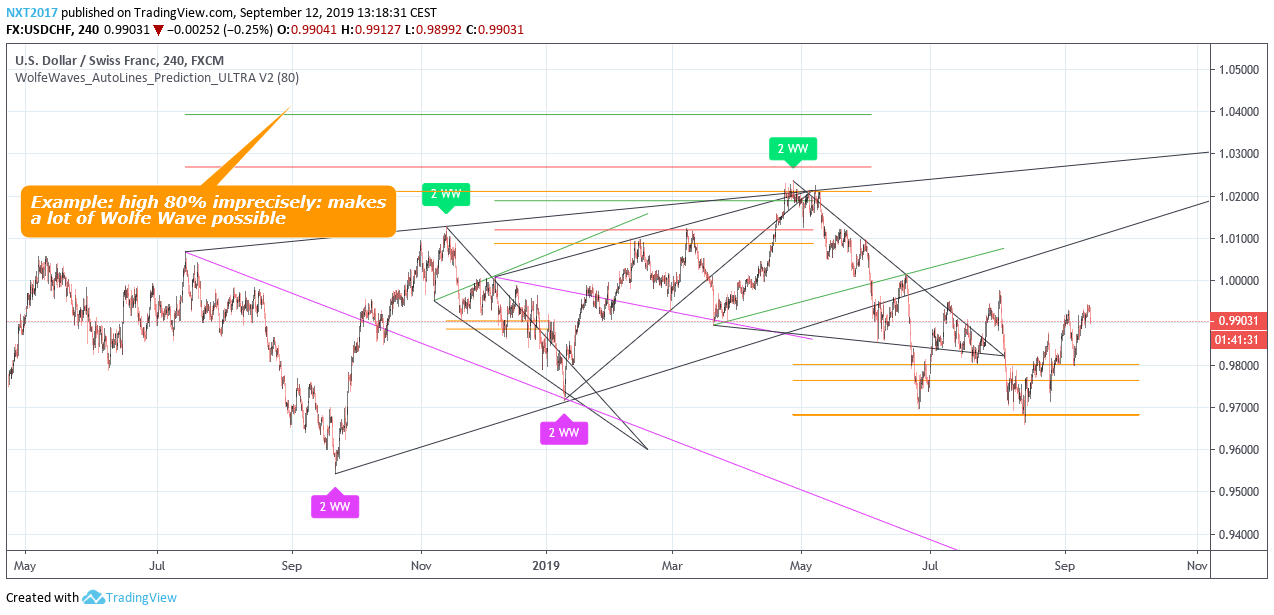

When drawing the pattern, sometimes the problem arises that too many lines are drawn. The reason for this is the TradingView platform itself. To prevent TradingView servers from collapsing, a maximum of 50-55 lines/labels per indicator is allowed.

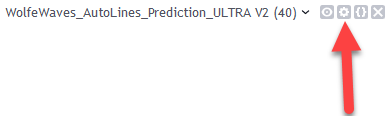

To work around this problem, the indicator offers two options in the settings. The settings of the indicator can be opened in the upper left corner behind the indicator name:

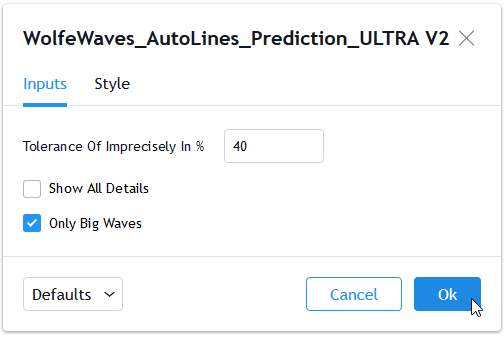

After opening the settings, the following screen appears:

- Tolerance Of Imprecisely In %: On perfect wolf waves, points 1-2 and 3-4 are synchronous. However, such perfect Wolves Waves are quite rare to find on the chart. Therefore, you can use this number to determine the maximum extent to the differences between the rules and reality may go. At the lower picture you can see the angles of line 1 to 2 and line 3 to 4. These angles are divide against each other. Based on the example (-67° : -64° = 1.04…) the “Tolerance Of Imprecisely” is 4%. The example gives you a rough idea of how high you should set this number. But everyone has to make his own experiences with this setting. We recommend a setting between 20 and 40. The higher this number is, the more possible wolves waves are drawn in. However, with too high number the probability of false wolf waves increases.

- Show All Details: This adds all additional lines and labels to the essential patterns. But beware, TradingView allows a maximum of 50-55 lines/labels per indicator. If you want the additional lines to be displayed, you should not zoom the chart backwards. This prevents loading other lines/labels from the past and allows full concentration on the current Wolfe Wave pattern.

- Only Big Waves: This option allows you to focus only on the large waves when you get an error message from too many drawn lines and labels. To analyze smaller wolves waves, you can open the chart in smaller time units.

Unlock the secrets of the markets: The Wolfe Wave Indicator for TradingView

In the world of trading, the ability to accurately predict market movements is the key to success. This is where the Wolfe Wave Indicator for TradingView comes into play, a revolutionary tool specifically designed to help traders identify potential price movements. This indicator uses the concept of Wolfe waves, a chart pattern that shows how prices oscillate in natural rhythms, to predict future price targets and reversal points.

Why the Wolfe wave indicator?

The Wolfe Wave Indicator for TradingView represents a new era of market analysis. It offers an intuitive, user-friendly interface that enables even beginners to understand and utilize the complex patterns underlying the financial markets. Through the precise line display of calculated trend reversal points, this indicator enables traders to trade a successful Wolfe wave pattern with higher chances.

How does the Wolfe wave indicator work?

The Wolfe Wave Indicator is based on the identification of a specific pattern consisting of five waves that form a natural market structure. These waves follow a defined rhythm: two of them form the trend line, while the other three work against this trend. By recognizing these patterns, the indicator helps traders identify potential targets for entry and exit, which is a valuable strategy for risk management.

Practical tips for using the Wolfe wave indicator

- Understand the basic principle: Start by familiarizing yourself with the concept of Wolfe waves. This knowledge is crucial in order to be able to use the indicator effectively.

- Observe and learn: Use the indicator to analyze historical data and get a feel for how patterns look and evolve.

- Risk management: Always place stop-loss orders to protect your investments, especially if you are still in the learning phase.

- Exercise patience: Wait for clear signals from the indicator before you act. Hasty decisions can lead to losses.

Reviews

There are no reviews yet.